If you or a loved one is suffering from a disability that interferes with your ability to work, it may be advisable to explore the possibility of receiving Social Security Disability (SSD) benefits. However, winning Supplemental Security Income (SSI) benefits or Social Security Disability Insurance (SSDI) benefits through the Social Security Administration (SSA) is not simple and straightforward. Complex application procedures and tight federal regulations set up by the SSA make it difficult and complicated to apply successfully for SSI or SSDI benefits. More than two-thirds of all applications for SSDI or SSI made to the SSA result in a notice of denial.

Before applying for disability benefits, you may face several doubts and questions. One such question is whether you can currently work and still receive the benefits you need. If so, how many hours can you work and remain eligible for SSDI or SSI benefits? An experienced and knowledgeable Social Security Disability benefits lawyer at Clauson Law can help you understand the complicated SSD benefits rules and assess whether you qualify for the benefits you need.

It is however important to keep in mind that the number of hours you work does not affect the eligibility criteria for winning SSI or SSDI benefits. Rather, your eligibility for winning disability benefits is affected by your earnings. If your earnings do not fall within the strict limits set for SSDI or SSI programs, you will not be able to qualify for disability benefits from the SSA. In this blog post, we will explain the qualification criteria for Social Security Disability Insurance benefits and Supplemental Security Income benefits, and the earnings that you can make while on disability.

What is SSDI?

SSDI is a federal insurance program managed and administered by the SSA. It is funded by the taxes paid into the Social Security system out of the income earned at a job or through self-employment. Therefore, the Social Security taxes that you pay out of your income contribute towards your eligibility to receive SSDI benefits from the Social Security Administration.

The SSDI program provides monthly benefits to individuals who are rendered unable to work because of a medically determinable physical and/ or mental impairment(s) that have lasted for at least 12 months or is expected to last for at least 12 months or result in death. An accomplished and knowledgeable SSDI benefits lawyer at Clauson Law can help you navigate through the complicated and complex SSDI benefits application process and tight federal regulations established by the SSA.

How To Qualify For SSDI Benefits?

To satisfying the criteria for winning Social Security Disability Insurance benefits, you must prove that you meet the following three conditions:

- You suffer from a disability, that is, you are affected by one or more medical conditions that meet the Social Security Administration's meaning and standard for a disability.

- You are prevented from working for a period of one year because of your disability.

- You must have worked for a long enough duration at a job or through self-employment and paid sufficient Social Security taxes out of your income to qualify for SSDI benefits as per the standards set by the Social Security Administration.

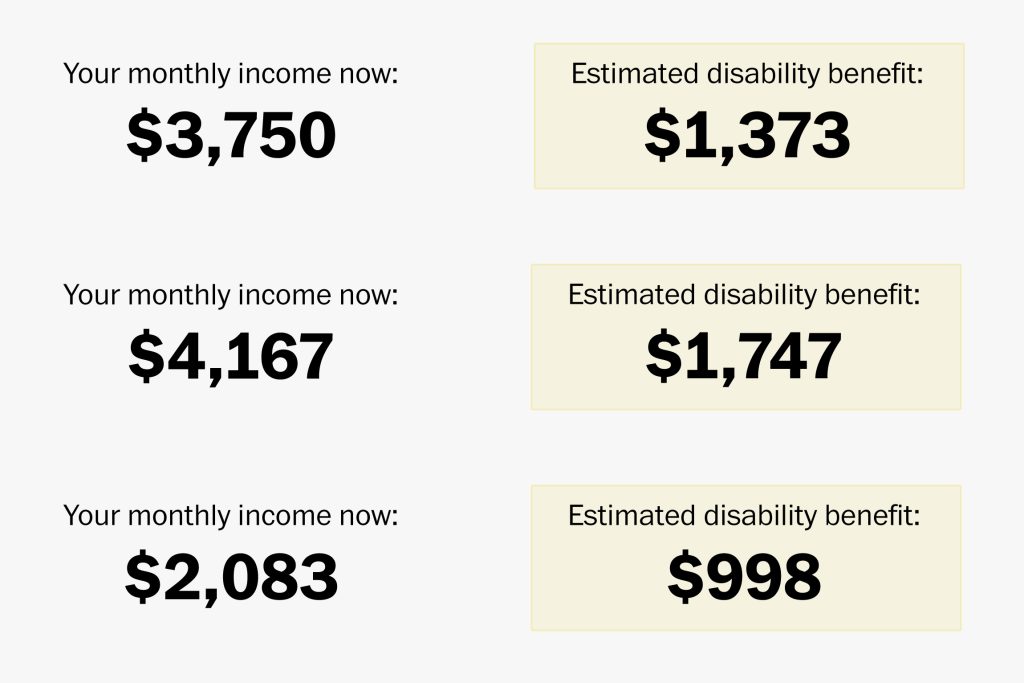

The SSDI benefits that you can receive from the SSA depend on several factors, the most important of them being the earnings record and your work credits. Your work credits are calculated based on your lifetime earnings. The higher your earnings and Social Security taxes, the more you receive in the form of SSDI benefits. An experienced SSDI benefits lawyer at Clauson Law will help go through your earnings record and assess the SSDI benefits to which you are entitled.

Qualifying For SSI Benefits

Supplemental Security Income is not a federal insurance program unlike Social Security Disability Insurance, rather it is a means-tested program administered by the SSA to help disabled individuals who do not have sufficient income or resources to meet their daily expenses. Therefore, you do not need a prior work history, earnings record, or work credits to qualify for the SSI program. To qualify for SSI benefits, the applicant must be 65 or older, blind, or disabled.

However, to qualify for SSI benefits, you must prove that you meet the income and resource limitations set by the Social Security Administration.

The resource limitations include bank accounts and other financial accounts, life insurance, land, vehicles, and other private property. For the purposes of SSI, resources include anything that can be sold and used to acquire food or shelter. To be eligible for receiving SSI benefits, an individual can have resources worth up to $2,000 and a married couple can have resources worth up to $3,000.

However, winning SSI benefits is not simple and straightforward because of the complicated procedures and technicalities that make it extremely difficult for individuals to understand if they qualify for the needs-based program. This makes it very tricky for an applicant to navigate through the SSI applications process. However, a knowledgeable and experienced SSI benefits lawyer at Clauson Law can help you win the benefits you need and deserve.

How Much Can You Earn On Disability?

To be eligible for winning SSI or SSDI benefits, an applicant must prove inability to engage in substantial gainful activity (SGA). A person who is earning more than a certain stipulated amount monthly is considered to be engaging in substantial gainful activity. The stipulated amount of monthly earnings generally depends upon the type of disability that an applicant is suffering from.

The first month you earn more than the SGA limit, the Social Security Administration will no longer deem you disabled. You will get benefits only for that month and the two upcoming months. This period is called the grace period and after that the benefits will stop.

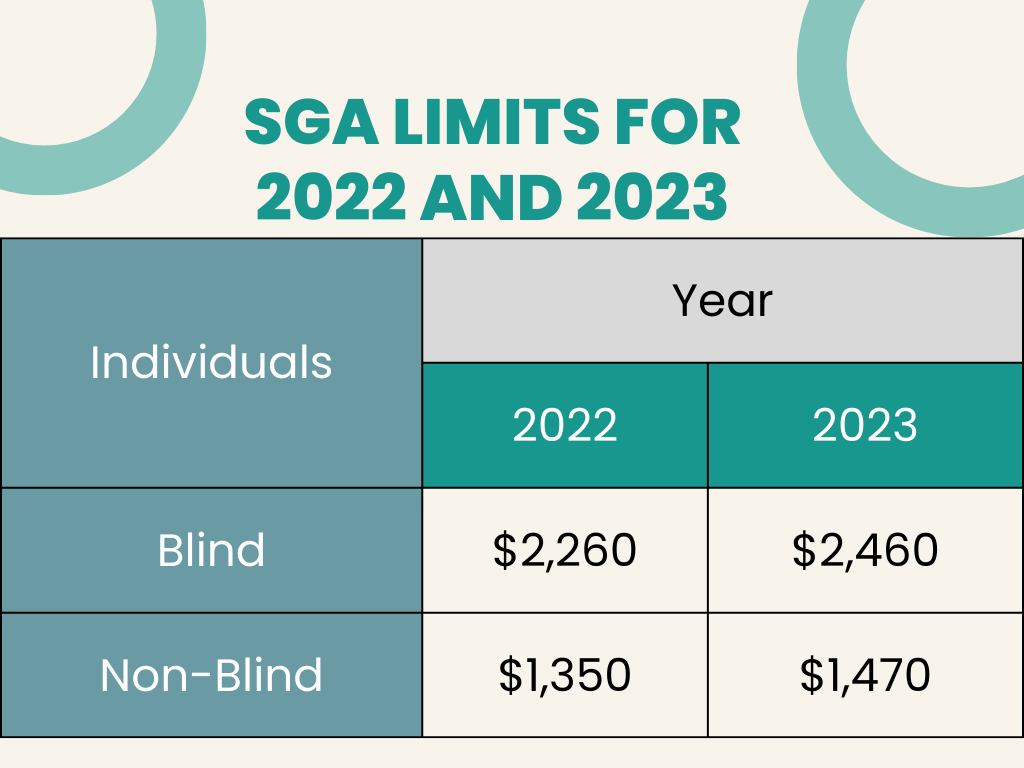

The Social Security Act prescribes a higher SGA amount for statutory blind individuals, whereas the federal regulations provide for a lower SGA amount for non-blind applicants. SGA amounts for blind and non-blind individuals change yearly depending on the national average wage index.

SGA Limits for 2022 and 2023

The monthly SGA amount for statutorily blind individuals is $2,260 in 2022 and $2,460 in 2023. For non-blind individuals, it is $1,350 in 2022 and $1,470 in 2023. SGA limit for blind individuals does not apply in the case of SSI benefits. However, the SGA for non-blind individuals applies in the case of both SSDI and SSI benefits.

While the SSI and other needs-based programs count other types of income for determining eligibility, the SSA only looks at your earnings when calculating your SSDI qualification. This means that only the money you earn as an employee, contractor, or self-employed worker goes toward your SGA limit.

Therefore, if you have some earnings in the unconventional ways, including stock market investments, real estate investments, or selling assets to gain extra income, you can do it without affecting your SSDI benefits, or requirement of reporting financial gains provided you are not operating a business. The SSA rules are different when you are counting income for SSI purposes. Under this program, you will not qualify for continued benefits if your income goes beyond the SSA's limits.

If you need any help considering whether your income should be counted towards considering eligibility for SSI or SSDI benefits, an SSI or SSDI benefits lawyer at Clauson Law may offer some much-needed help.

Trial Work Period

Social Security Disability benefits are intended to help those who are unable to work because of a disability. However, they are not meant to prevent a person with disability benefits from returning to work. As an incentive, the SSA provides a trial work period (TWP) during which a beneficiary may have earnings and still collect benefits. However, the trial work period does not apply in the case of SSI benefits. The monthly earnings that trigger a trial work period are lower than the SGA amounts.

Apart from this, SSDI beneficiaries are also allowed a trial period of up to nine months during which they can test their ability to work. The trial months can be spread out over five years. During these months, you can get your full benefit irrespective of your earnings.

Contact An Experienced And Knowledgeable SSD Benefits Lawyer At Clauson Law Today

It is understandable if you want to try working while you are receiving disability benefits. However, the Social Security Disability application process and federal regulations are extremely complicated and complex. As such the number of hours for which you work does not affect your ability to earn SSI or SSDI benefits, but the amount of money that you are earning may affect your eligibility for disability benefits.

Therefore, you must consult an experienced and knowledgeable Social Security Disability benefits lawyer who can help you understand whether you can qualify for the benefits you need with your current income. If you want to speak with an accomplished Social Security Disability benefits lawyer, you may contact an experienced and knowledgeable SSD benefits lawyer at Clauson Law today.