Top 10 Reasons Short-Term Disability Claims Are Often Denied

Short-term disability benefits could be the difference between having money to pay bills when you cannot work and financial hardship. Simply because you have a short-term disability insurance policy provided by your employer or purchased on your own is no assurance of receiving benefits when an illness or injury prevents you from working.

Disability lawyers at the Clauson Law Firm, PLLC, understand the importance of short-term disability benefits. They want you to have the most current information available to put you in the best possible position to protect your right to benefits.

This article helps you to understand how disability insurance works. Included are the 10 most common reasons short-term disability can be denied, along with the steps you should take to challenge a denial of benefits.

What Is A Short-Term Disability?

A short-term disability is when an injury or illness that is not work-related prevents you from working for a defined period of time, usually up to one year. The exact length of time depends on the terms of the insurance policy that you or your employer purchased.

Work- or job-related conditions are generally excluded from coverage under short-term disability insurance policies because of workers’ compensation. State laws require employers to cover their employees for injuries and illnesses caused by work-related accidents or conditions through workers’ compensation insurance that provides benefits, including wage replacement and medical care.

Policies can define a short-term disability by the number of months a condition lasts, but anything longer than 12 months usually qualifies as a long-term disability. For example, Social Security Disability Insurance is available to workers based on how long they worked at jobs or through self-employment and paid Social Security taxes on their income.

The SSDI program pays benefits to workers who cannot work because of a medically determinable physical or mental impairment that has lasted or is expected to last for at least 12 months or is likely to result in the person’s death. If you cannot work because of a disability lasting less than 12 months, then short-term disability insurance or an employer-provided plan would provide the necessary benefits until you can return to work or apply for SSDI.

The types of conditions that qualify for benefits through short-term disability insurance depend on the terms of the policy. Most plans provide benefits for pregnancy and maternity leave, but not all cover disabilities caused by mental health conditions. Check with your insurance company or employer for coverage and exclusions.

Does State Law Require Employers To Provide Short-Term Disability?

Only a few states make employers offer short-term disability insurance or plans to their workers. Short-term disability and temporary disability laws exist in only the following states:

- California

- Hawaii

- New York

- New Jersey

- Rhode Island

If you work in one of these states, your employer pays the cost of covering under a plan or insurance policy that pays a portion of your lost wages when you cannot work because of an injury, illness, or pregnancy. Other states leave it to employers to determine whether to offer it as a benefit or let people purchase a disability policy on their own from an insurance company.

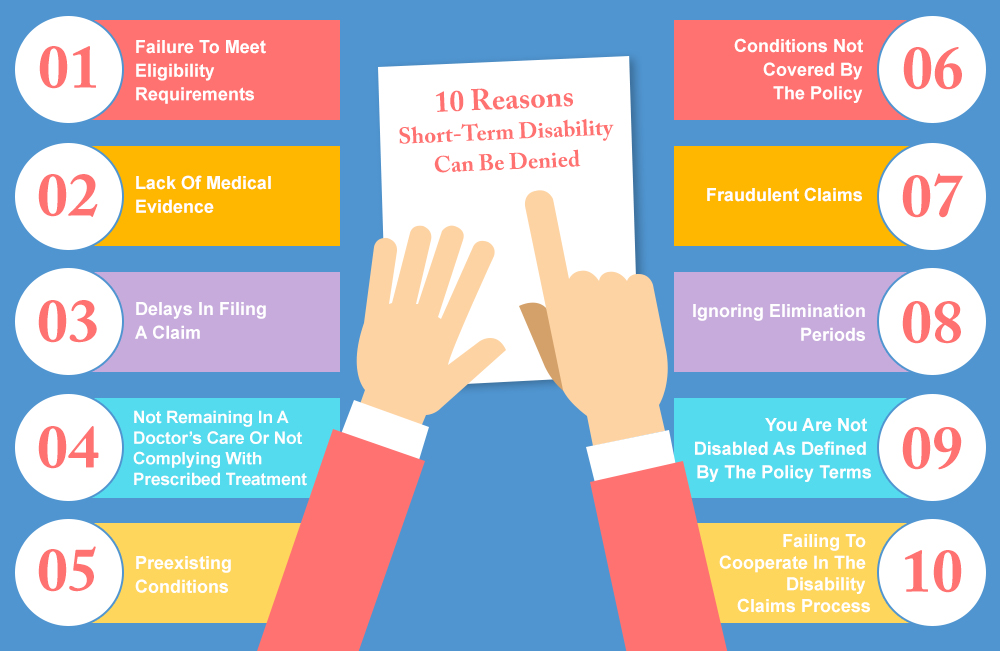

Top 10 Reasons Short-Term Disability Can Be Denied

Whether you file a claim through an employer-provided plan or through a disability insurance policy that you purchased, the following are 10 common reasons short-term disability can be denied:

- Failure To Meet Eligibility Requirements: If you have a policy or plan with eligibility requirements, you must meet them to qualify for benefits. For example, some employer-provided programs may offer benefits only if you work a minimum number of hours per week. Check your policy or plan to ensure you meet all the eligibility requirements, or seek advice from a disability attorney at the Clauson Law Firm.

- Lack Of Medical Evidence: A claim for short-term disability benefits requires proof that you have a qualifying medical condition. Medical records, including doctor’s notes, diagnostic testing, and lab results, must prove the cause ad severity of your disability. Check with your doctors to ensure your medical records contain the latest information about your condition.

- Delays In Filing A Claim: Once a doctor informs you of a disabling condition, you must file a claim for benefits within the time required by your insurance company or employer-provided plan. When you cannot work because of injury, illness, or pregnancy, applying for disability benefits needs to be a priority.

- Not Remaining In A Doctor’s Care Or Not Complying With Prescribed Treatment: The benefits provider may deny your claim for not staying under a doctor’s care or not following a doctor’s prescribed course of treatment. Not taking medication or participating in physical therapy may hinder recovery from an accident and illness and delay a return to work. For this reason, it’s relatively easy to avoid a claim denial by simply showing up at scheduled appointments with all healthcare providers and following the treatment plans they prescribe for you.

- Preexisting Conditions: Disability insurance companies typically ask about preexisting medical conditions when you apply and may exclude disclosed conditions or related conditions from coverage. If you have a claim denied because of a preexisting condition, have a Clauson Law Firm disability attorney review the denial and the terms of your policy to determine whether the denial can be appealed.

- Conditions Not Covered By The Policy: Some disability insurance plans specifically exclude mental health conditions, substance abuse, self-inflicted injuries, and illnesses or injuries occurring through activities related to a claimant’s employment from coverage. This is again one of those situations when knowing the terms of a disability insurance policy or employer-sponsored program can avoid making a claim that will be denied. If you have a right to file for workers’ compensation benefits for a job-related illness or injury, the delay caused by filing a disability claim could affect your rights with the workers’ compensation insurance carrier.

- Fraudulent Claims: A benefit claim will be denied when a claimant provides information or documentation to an insurer knowing it is inaccurate or misleading. Be truthful when applying for short-term disability insurance and when claiming benefits.

- Ignoring Elimination Periods: Disability insurance policies and plans offered by employers usually have a waiting period that you may see referred to in your policy as an elimination period. It’s how long you must be disabled and unable to work before you may begin receiving short-term disability benefits. Typical periods are up to 14 days though it could be shorter or longer, so check the terms of your coverage to ensure that your claim is not filed too soon.

- You Are Not Disabled As Defined By The Policy Terms: You may be denied benefits if your disability insurance only provides benefits for total disability and you can do some of the activities required for your job. The ability to do some work activities means you are partially disabled, which would disqualify you from being approved for benefits when your policy requires total disability.

- Failing To Cooperate In The Disability Claims Process: You may be asked to supply additional documentation and information supporting your claim for benefits, or you may be scheduled for an independent medical examination (IME) by a physician or other medical professional chosen and paid for by your insurance company. If you do not cooperate with the insurer, your claim for short-term disability can be denied.

These are the 10 most common reasons short-term disability can be denied, but there are others that you may encounter. For example, a claim for benefits will be denied if the company paying benefits learns that you are working at another job while claiming to be disabled.

Fighting The Denial Of Short-Term Disability Benefits

Either your employer, if you have an employer-sponsored disability plan, or your insurance company must send you written notification of the decision made on your claim for short-term disability. If your claim is denied, you have a right to appeal the determination, but you must act quickly.

The time you have to file an appeal is determined by the terms and conditions in your insurance policy or under the disability program through your employer. It varies, so schedule a free consultation with a Clauson Law Firm disability lawyer to have the denial notice reviewed and acted upon as quickly as possible. Missing the filing deadline for appealing an adverse decision may leave you without recourse against the insurer or company.

Some denials may be resolved simply by having an experienced disability lawyer contact the company and discuss why the claim is not approved. It may be as simple as a doctor’s office not sending your complete medical record to the insurer, or it may require an appeal. Either way, your attorney can quickly determine the best way to challenge the denial of benefits.

Get Advice From An Outstanding North Carolina Disability Lawyer

When you have questions or concerns about short-term disability, long-term disability, and Social Security disability, including benefits, applications, and appeals, speak to a disability lawyer at the Clauson Law Firm. Contact us today to schedule a free consultation.

1 Comment

Thanks for the advice that you should consider disability claims for your illness since this can help individuals receive a settlement for their injuries. I can see how this could help individuals who have been injured severely and how it affects their work. I will be sure to keep this in mind if I experience something similar in my line of work.