How Much Does A Child With Autism Get From SSI?

The amount of Supplemental Security Income (SSI) that a child with autism may receive depends on several factors, including the child’s age, the income and resources of the child and their family, and the state where they live.

As of 2021, the federal maximum SSI payment for a child is $794 per month, but this amount may be reduced based on the child’s income and resources, as well as any other income or benefits the child may receive.

In addition, some states provide supplemental payments to SSI recipients, which can increase the total amount of SSI a child with autism may receive.

It’s important to note that the SSI program is means-tested, which means that eligibility and payment amounts are based on financial need. Therefore, the amount of SSI a child with autism may receive may vary depending on their circumstances.

What Is SSI?

SSI stands for Supplemental Security Income. It is a needs-based program administered by the Social Security Administration (SSA) in the United States. SSI provides cash assistance to elderly, blind, and disabled individuals with limited income and resources.

The program is designed to help eligible individuals and families meet their basic needs for food, shelter, and clothing. Eligibility for SSI is determined by the individual’s income and resources, as well as their age, disability status, and citizenship or immigration status.

The amount of SSI benefits an individual receives is based on their income and resources, and it can vary depending on the individual’s living situation, such as whether they live alone, with a spouse, or with others.

In addition to providing financial assistance, SSI also provides access to Medicaid health insurance in most states. This can help individuals with disabilities pay for necessary medical services and medications.

It’s important to note that SSI is separate from Social Security Disability Insurance (SSDI), a program that provides benefits to individuals who have worked and paid Social Security taxes but can no longer work due to a disability.

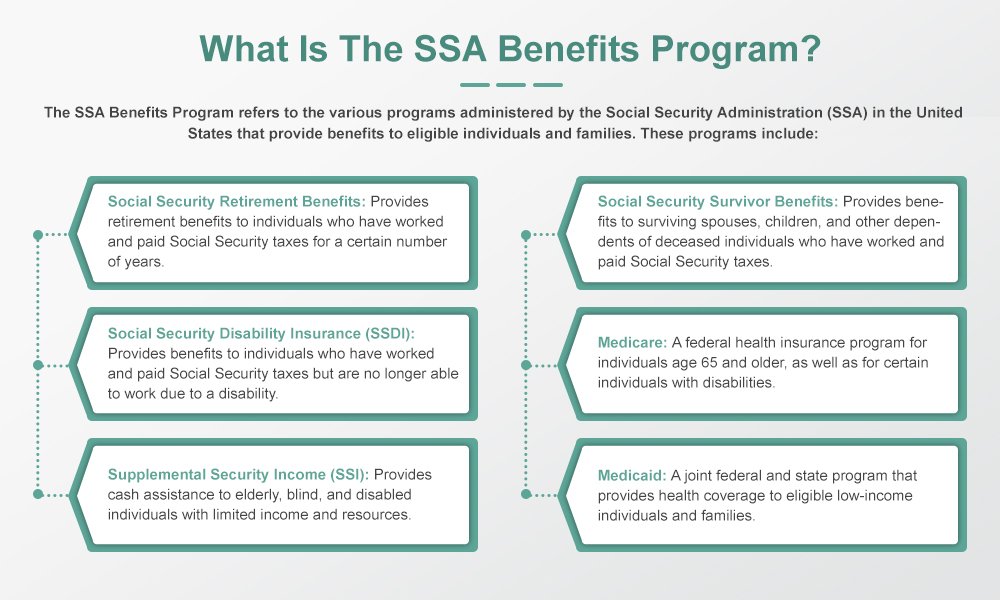

What is the SSA Benefits Program?

The SSA Benefits Program refers to the various programs administered by the Social Security Administration (SSA) in the United States that provide benefits to eligible individuals and families. These programs include:

- Social Security Retirement Benefits: Provides retirement benefits to individuals who have worked and paid Social Security taxes for a certain number of years.

- Social Security Disability Insurance (SSDI): Provides benefits to individuals who have worked and paid Social Security taxes but are no longer able to work due to a disability.

- Supplemental Security Income (SSI): Provides cash assistance to elderly, blind, and disabled individuals with limited income and resources.

- Social Security Survivor Benefits: Provides benefits to surviving spouses, children, and other dependents of deceased individuals who have worked and paid Social Security taxes.

- Medicare: A federal health insurance program for individuals age 65 and older, as well as for certain individuals with disabilities.

- Medicaid: A joint federal and state program that provides health coverage to eligible low-income individuals and families.

The SSA Benefits Program is designed to provide financial assistance and support to eligible individuals and families who have paid into the Social Security system through their work or who meet the eligibility criteria for other assistance programs.

How To Qualify for the SSI Benefits Program?

To qualify for Supplemental Security Income (SSI) benefits, an individual must meet the following criteria:

- Age, Disability, or Blindness: The individual must be either 65 years of age or older, blind, or disabled. To be considered disabled, the individual must have a medical condition that is expected to last for at least one year or result in death.

- Limited Income: The individual’s income must be below a certain level. In 2021, the federal benefit rate for an individual is $794 per month, and the income limit is $794 per month. However, not all income is counted when determining eligibility for SSI, so it’s important to speak with an SSA representative to determine eligibility.

- Limited Resources: The individual’s resources (i.e., assets such as cash, bank accounts, and property) must be below a certain limit. In 2021, the limit is $2,000 for an individual and $3,000 for a couple.

- Citizenship or Immigration Status: The individual must be a U.S. citizen or meet certain immigration status requirements.

- Residency: The individual must reside in one of the 50 states, the District of Columbia, or the Northern Mariana Islands.

It’s important to note that the SSI program is needs-based, which means that eligibility and payment amounts are based on financial needs. Therefore, the amount of SSI a person may receive may vary depending on their individual circumstances.

Common Challenges Families May Face When Applying for SSI Benefits for a Child with Autism

Families may face several challenges when applying for Supplemental Security Income (SSI) benefits for a child with autism. Here are some of the most common challenges:

- Meeting the eligibility criteria: The eligibility criteria for SSI benefits can be complex and difficult to navigate, particularly for families who have never applied for benefits before. Families may struggle to provide the necessary documentation and information to establish the child’s disability and financial needs.

- Gathering medical evidence: To establish a child’s disability, families must provide medical evidence that supports the child’s diagnosis of autism and demonstrates the severity of their symptoms. This can be challenging, particularly if the family does not have regular access to medical care or the child’s medical records are scattered across multiple providers.

- Providing detailed information: Families must provide detailed information about their child’s condition, including how their symptoms affect their daily activities and ability to function. This can be difficult, particularly if the child’s symptoms are variable or the family is unfamiliar with the information the SSA needs.

- Dealing with long wait times: The SSI application process can be lengthy, with wait times of several months or more common. This can be particularly challenging for families who are struggling to meet their child’s basic needs without the additional financial assistance that SSI would provide.

- Appealing denied claims: Even when families provide all the necessary information and documentation, their child’s SSI claim may be denied. Families may need to appeal the decision, which can be time-consuming and stressful.

- Understanding the impact on other benefits: Families may not understand how applying for SSI benefits for their child with autism could affect their eligibility for other benefits, such as Medicaid or other government assistance programs.

Overall, applying for SSI benefits for a child with autism can be a complex and challenging process, and families may need support and guidance to navigate it successfully.

Financial Requirements To Qualify for SSI Benefits

To qualify for Supplemental Security Income (SSI) benefits, an individual must meet certain financial requirements. Specifically, the individual’s income and resources must be below certain limits.

For 2021, the federal benefit rate for an individual is $794 per month, and the income limit is $794 per month. However, not all income is counted when determining eligibility for SSI. Some types of income, such as food or shelter provided by someone else, may not count towards the income limit. Additionally, there are certain deductions that can be made from an individual’s income, such as work-related expenses, that may lower the amount of income counted towards the limit.

In 2021, the resource limit is $2,000 for an individual and $3,000 for a couple. Resources include assets such as cash, bank accounts, and property. Certain assets, such as a primary residence, personal belongings, and a vehicle used for transportation, may be excluded when determining the total amount of resources.

It’s important to note that the income and resource limits can change each year, and different rules may apply for individuals who are married or have dependents. Additionally, not all income and resources are treated the same way, and some types of income or resources may have different rules or exclusions. It’s important to speak with a Social Security Administration representative to get more specific information about eligibility requirements.

What About When Or If My Child Is Already 18?

If your child with autism is already 18 years old, they may be eligible to apply for Supplemental Security Income (SSI) benefits on their own, based on their disability and financial need.

When your child turns 18, they are considered an adult in the eyes of the Social Security Administration (SSA), and the rules for eligibility and benefits change. To qualify for SSI benefits as an adult, your child will need to meet the same eligibility criteria as any other individual, including having a medical condition that meets the SSA’s definition of disability and meeting certain financial requirements.

To be considered disabled, your child must have a physical or mental impairment that is expected to last at least 12 months or result in death, and that significantly limits their ability to perform basic work-related activities. The SSA will review your child’s medical records and other evidence to determine whether they meet this definition.

In addition to meeting the disability requirements, your child’s income and resources must be below certain limits to qualify for SSI benefits. For 2021, the income limit is $794 per month, and the resource limit is $2,000 for an individual.

It’s important to note that applying for SSI benefits can be a complex process, and it may be helpful to seek the assistance of an experienced disability attorney or advocate. They can help you navigate the application process and ensure that your child’s rights are protected.