Social Security (SSI & SSDI) Benefit Payments Schedule 2023

The Social Security Administration (SSA) provides monthly benefits to retired Americans, disabled workers, and survivor spouses. If you worked during the course of your life and paid into the social security system, you will be eligible to apply to receive Social Security Disability Insurance (SSDI) benefits following a disabling illness or injury. Supplemental Security Income (SSI), on the other hand, is a needs-based, cash assistance program that assists those who are disabled, elderly (aged above 65), or blind. Unlike the SSDI, an applicant for SSI need not have paid into the Social Security system. To be eligible, the applicant must have little to no income or assets.

If you are eligible under a Social Security Disability program, you will get your disability benefits in the form of monthly lump sum payments. The payment dates for Social Security benefits are pre-determined by the Social Security Administration. Depending on the Social Security program for which you are eligible, you will get monthly benefits either on the basis of your date of birth or on a particular day of the month fixed by the Social Security Administration.

Understanding the Social Security Disability (SSD) system

Social Security is formally called the Old Age, Survivors, and Disability Insurance (OASDI) program. It provides monthly benefit payments to qualified workers and their dependents. Eligibility and benefit amounts for the Social Security programs are based on the number of years for which the applicant worked, and the amount deposited into Social Security over those years. While Social Security includes different kinds of benefits, Social Security Disability includes two programs administered by the SSA-

Social Security Disability Insurance (SSDI)

SSDI is a federal insurance program that is administered by the Social Security Administration. It was established in the year 1954 with the object of providing individuals with a source of income in the eventuality of their becoming unable to work due to a disability. The SSDI program provides monthly benefit payments when medically determinable physical and/ or mental impairment(s) are expected to last for 12 or more months or result in death, preventing the applicant from working.

For receiving SSDI benefits, the Social Security Administration has to determine that the applicant is disabled. For this purpose, the following conditions must be satisfied-

- You are unable to engage in substantial, gainful activity due to the physical or mental impairment that is expected to result in death or has lasted or is expected to last, for at least one year.

- You are unable to handle the requirements of the job that you were able to handle before becoming disabled.

- You are unable to adjust to other types of work because of your physical or psychological condition.

- The disability is a consequence of a physical or psychological impairment that can be determined by the medically acceptable, laboratory, or clinical, diagnostic techniques.

The amount received in SSDI benefits depends on different factors and the most important of them all is your earnings record. SSDI benefits are calculated based on your earnings when you worked in the course of your lifetime. The more you earned and paid into the system in the form of Social Security taxes, the more you will receive SSDI benefits.

Supplemental Security Income (SSI)

Supplemental Security Income is a needs-based program that offers monthly benefit payments to disabled persons, blind adults, adults aged 65 or above, and children. Unlike SSDI, SSI is not a federal insurance program, and therefore an applicant may be eligible to receive SSI monthly benefit payments even without a prior work history or payment of Social Security taxes. Federal regulations impose strict income and resource limits on applicants along with medical conditions that must be met to qualify for SSI monthly payment benefits.

The SSA considers an individual for Supplemental Security Income benefits based on the following factors-

- You have little to no household income or other resources. As of 2022, an individual must have less than $861 per month in unearned income to receive SSI monthly benefit payments. On the other hand, a couple can get SSI if it has unearned income of up to $1,281 a month.

- You suffer from such a disability that is expected to last for at least 12 months or can be expected to result in death.

- You must have been rendered incapable of performing the work that you were doing before getting disabled or doing any other work on a regular basis.

Cost-of-Living Adjustments

The object of the Social Security Disability programs is a partial replacement of the income that an individual would have earned, but for the disabling illness or injury. Therefore, the Social Security benefit rates rise in line with the cost of living that is measured by the Department of Labor’s Consumer Price Index (CPI-W). As the inflation rate increases, the cost of goods and services also rises and so does the cost of living. In order to offset the enhanced costs and maintain the purchasing power of Social Security Disability benefits, the SSA issues what is known as a cost-of-living adjustment (COLA).

The Social Security Act itself stipulates a formula for computing COLA. It is based on the increases in the CPI-W. As such, a COLA is equal to the percentage rise in the CPI-W from the average for the current year’s third quarter to the average for the third quarter of the previous year in which a COLA was enacted. The increases are rounded off to the nearest tenth of 1%. If there is no increase or decrease in the Social Security Disability benefit rates for a specific year, then the Social Security Disability will not issue any COLA for that year.

Payment Schedule for 2023

Different schedules are followed for payment of SSDI and SSI monthly benefits by the SSA. While SSDI monthly benefit payments vary according to an individual’s date of birth, SSI benefit payments are pre-fixed according to a set schedule.

Payment Schedule for SSDI benefits

SSDI monthly benefit payments are scheduled depending on your date of birth. The payment schedule of SSDI benefits is similar to the payment of Social Security retirement, disability, and survivor benefits. The monthly benefit payments are distributed on any of three Wednesdays each month if you started receiving benefits after May 1997. The payment schedule is described below-

- If you were born between the 1st–10th, you will receive your SSDI benefits on the second Wednesday of each month.

- If you were born between the 11th–20th, you will receive the SSDI monthly benefit payments on the third Wednesday of each month.

- If you were born between the 21st–31st, you will receive the SSDI monthly benefit payments on the fourth Wednesday of each month.

However, if you started SSDI benefits in 1997 or earlier, you will receive your monthly benefit payments on the 3rd day of each month, regardless of when your birthday is. If the 3rd day happens to be a Saturday, Sunday, or a legal holiday, you will receive benefits on the previous banking day.

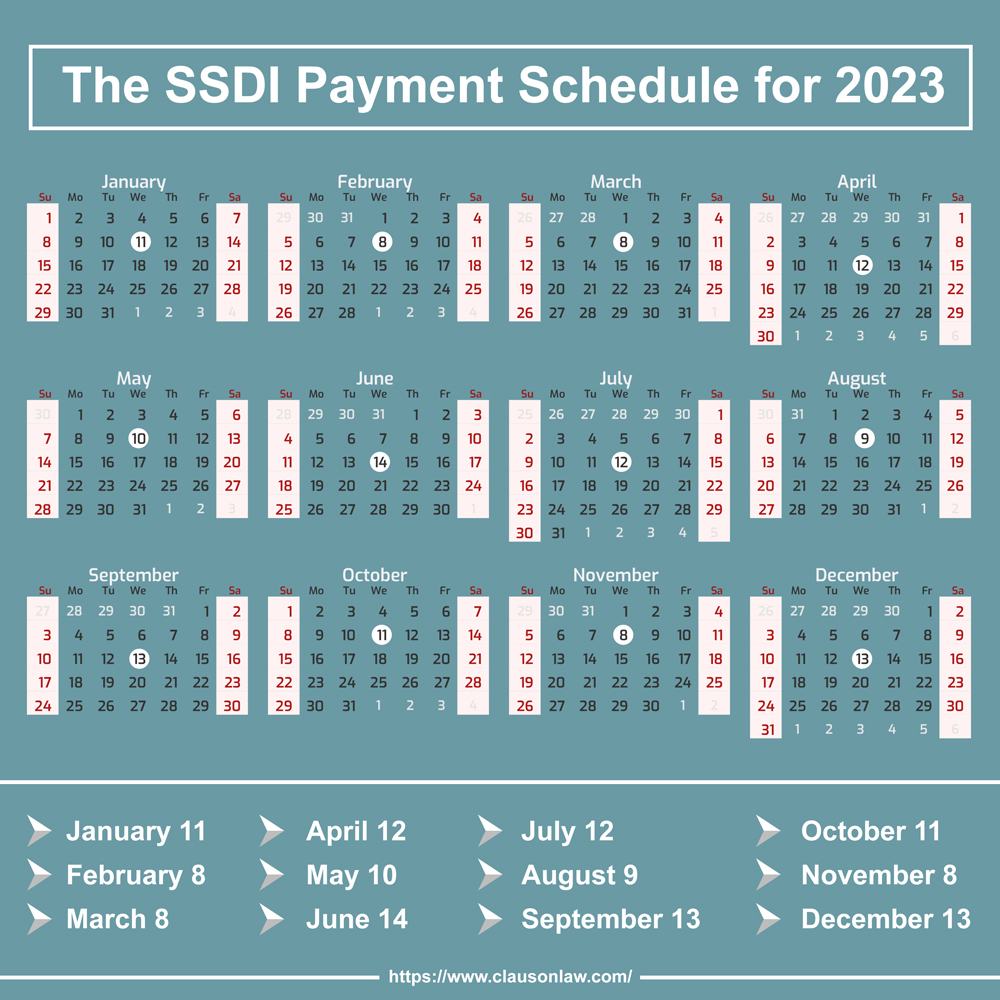

The SSDI payment schedule for 2023 for those whose birthdays fall between the 1st-10th of their month of birth is given below-

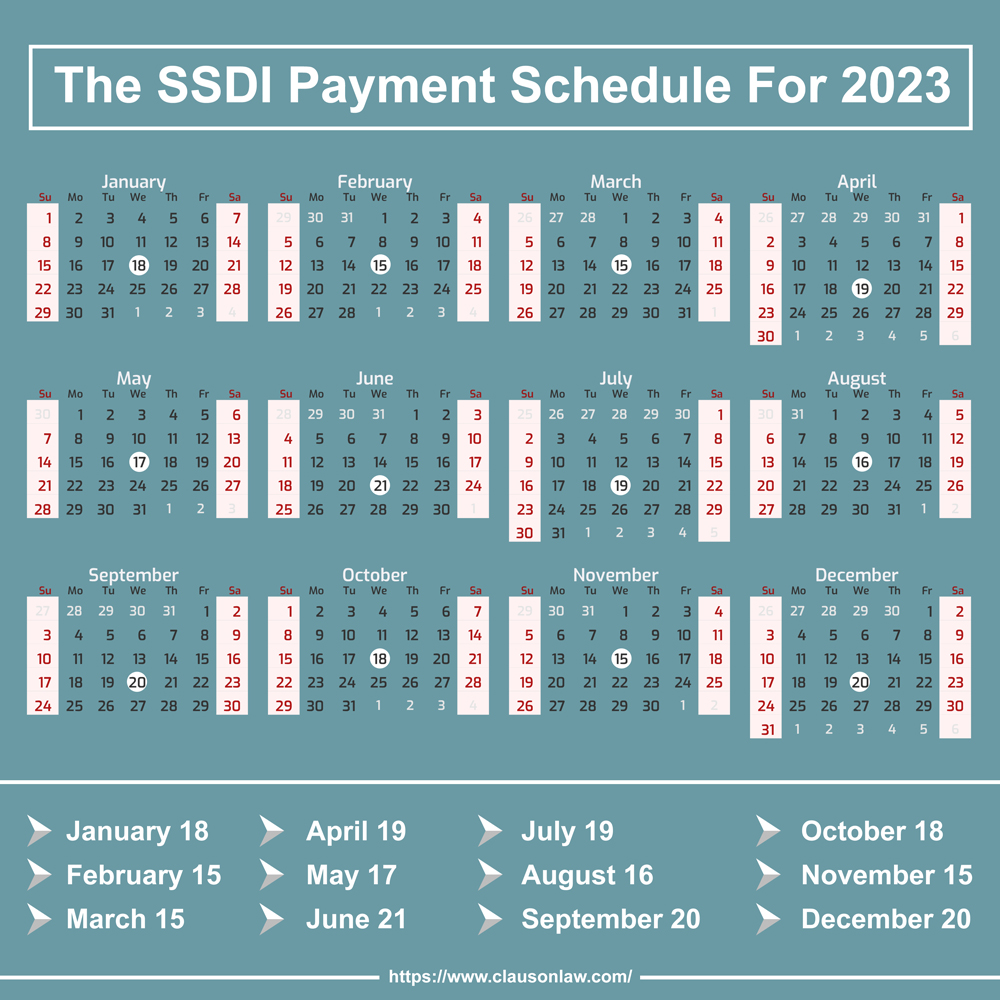

The SSDI payment schedule for 2023 for those whose birthdays fall between the 11th-20th of their month of birth is given below-

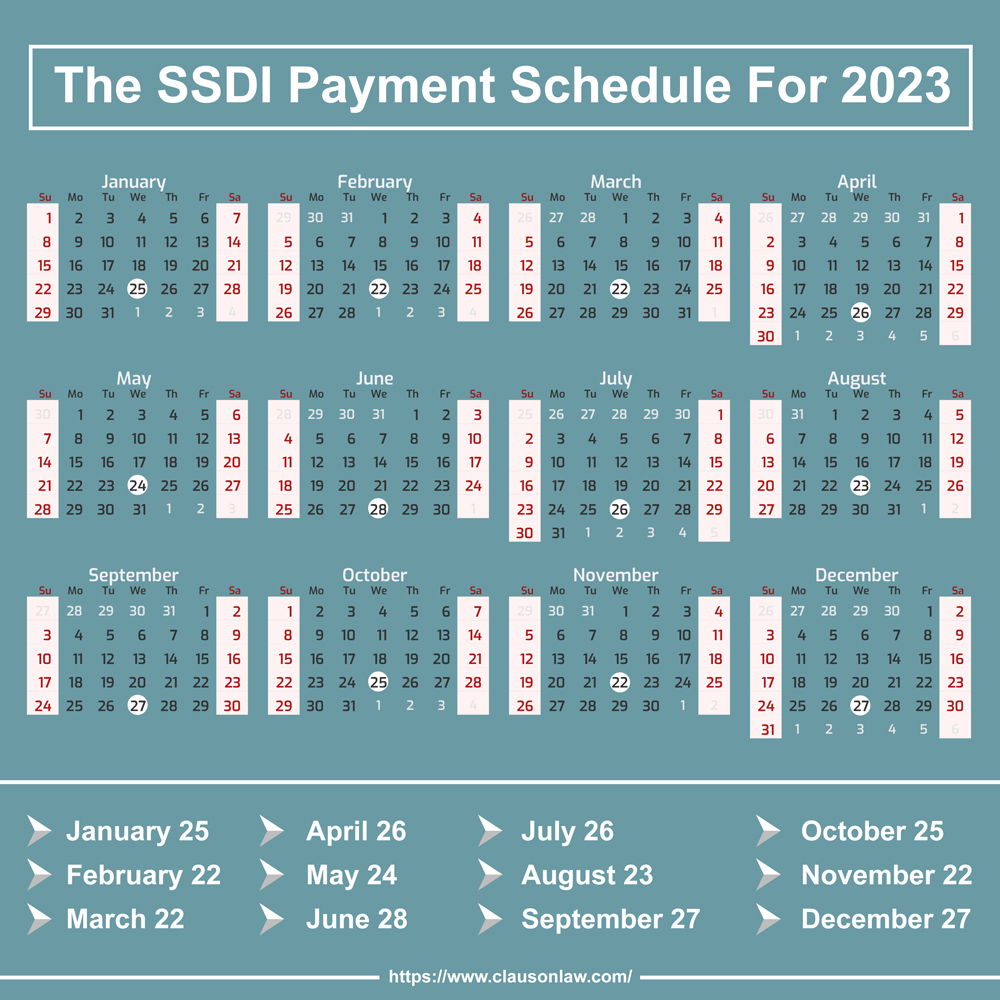

The SSDI payment schedule for 2023 for those whose birthdays fall between the 21st-31st of their month of birth is given below-

Here’s the SSDI payment schedule for 2023 for those who started receiving SSDI benefit payments in 1997 or earlier-

Payment Schedule for SSI benefits

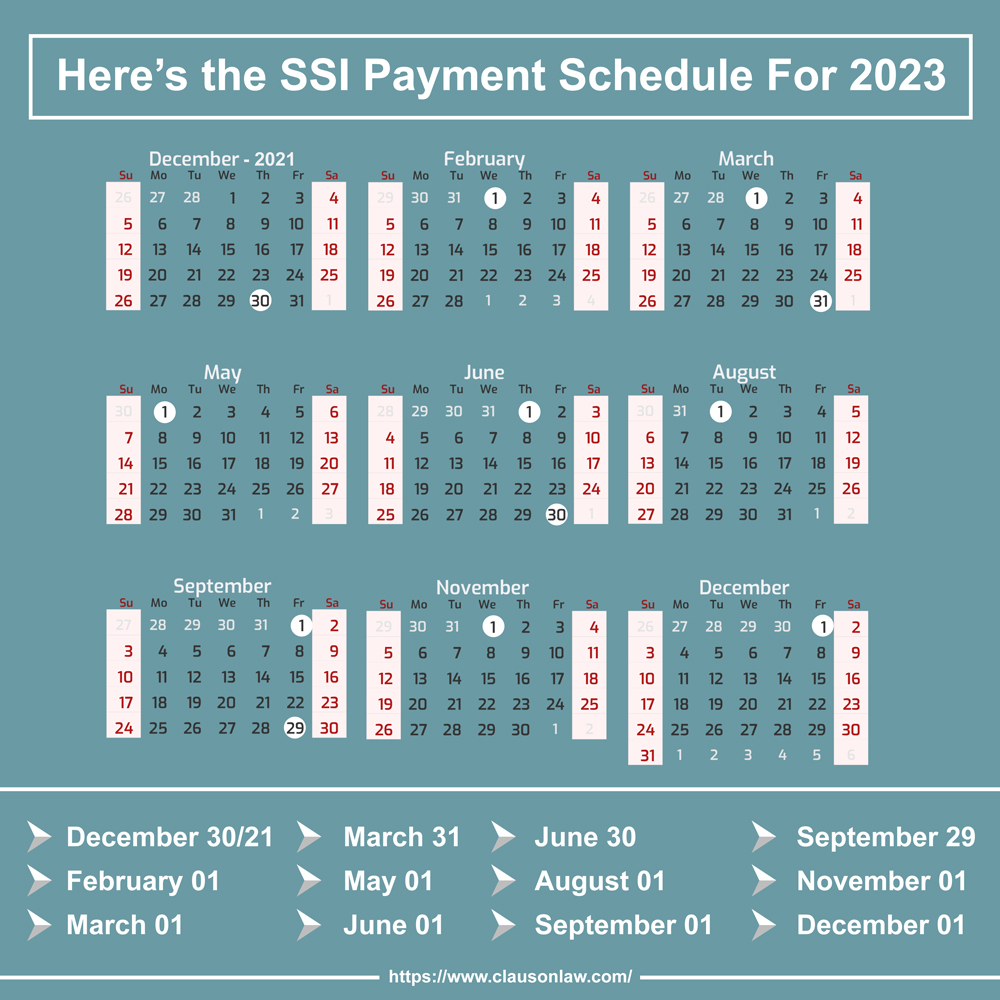

SSI monthly benefit payments are paid on the 1st day of each month. If the 1st is a Saturday, Sunday, or holiday, then you will receive the monthly benefits on the earliest previous working day. Here’s the SSI payment schedule for 2023-

Contact an experienced SSD lawyer today

Clauson Law boasts of a capable team of disability lawyers who are out there to get you the disability benefits that you are entitled to receive. We are not just a law firm, and we want to do everything possible to help you with your disability. Contact us today to talk to an experienced disability lawyer about your claim and start fighting for the benefits you deserve.

Who is entitled to Supplemental Security Income (SSI) benefits?

It is a needs-based program that provides monthly benefit payments to disabled persons, blind adults, adults aged 65 or above, and children.

How are Cost-Of-Living Adjustments (COLA) computed?

The Social Security Act provides a formula for computing COLA. It varies according to increases in the Consumer Price Index (CPI-W).

3 Comments

Thanks for the post. It will help many people who are looking for SSDI benefits.

If you want to know more about SSDI law the follow : http://www.ladaslaw.com

I need help getting my SSI or SSDI

Does ssdi get paid early I’m not quite understanding any if this stuff.do we get extra money this month?