How Much Social Security Will I Get At Age 63?

A common misconception about Social Security is that you must wait to collect retirement benefits until you reach reaching age 65 It is wrong for two reasons: The age at which you become eligible for full retirement benefits through Social Security may be older than 65 depending on the year you were born, and early Social Security retirement benefits may be available at age 62.

The taxes paid on what you earn from a job or through self-employment do more than fund the Social Security retirement and disability benefits programs. It also makes you eligible to receive Social Security disability benefits if you become disabled and unable to continue working and earning a living before reaching full retirement age. Your earnings record also determines how much you may receive as monthly retirement or disability benefits.

If you elect to retire sooner than the age of full retirement, the monthly benefit payment is reduced from what you would be eligible to receive by waiting until full retirement. It also may affect how much you receive in benefits through the Social Security Disability Insurance program.

It’s important for someone who may be thinking about applying for early retirement at age 63 to understand how it results in a reduced monthly benefit that does not end at full retirement age. You also need to be aware of what effect applying for early retirement benefits at age 63 will have on your SSDI benefits if you are disabled and unable to work.

What Is The Full Retirement Age For Social Security Purposes?

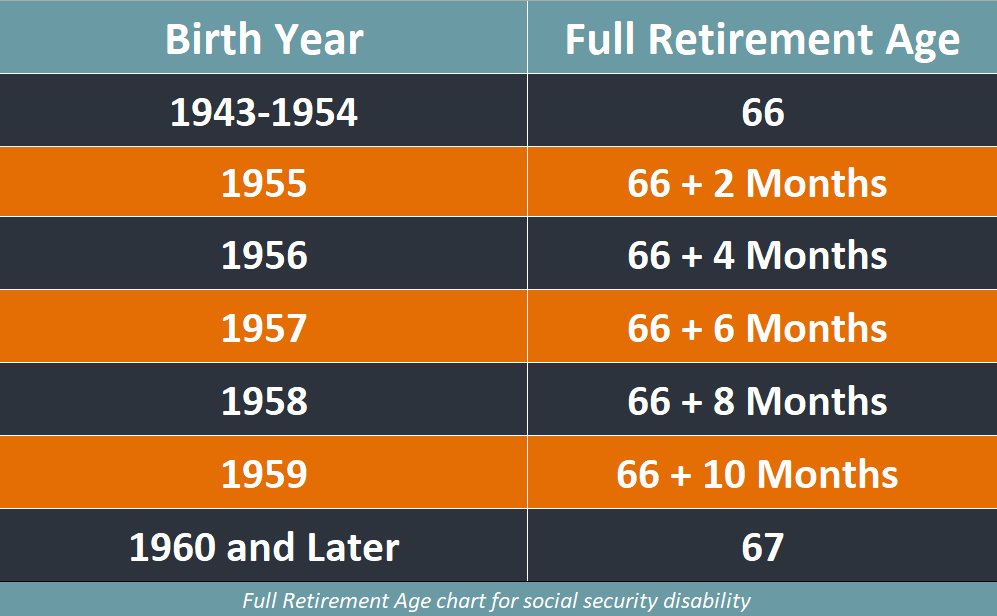

The association that people make between age 65 and Social Security benefits goes back to the Social Security Act of 1935. The law set 65 as the age at which a person became eligible to receive full retirement benefits from Social Security. Congress changed things with the passage of the Social Security Act of 1983 which increased the age to 67, but it did so gradually.

Age 65 remained the full retirement age for individuals born prior to 1938 and gradually increased it based on the year of birth of everyone born from 1938 until it reached age 67 for everyone born after 1959. The 1983 changes to Social Security did not change the early retirement age, which remains at 62.

Retirement Benefits At Age 63

If you elect to retire early, the benefits that you receive are less than you would get by waiting until you reach full retirement age. The Social Security Administration website automatically calculates your full retirement age based on the year that you were born. It also shows you how much of a reduction in benefits you can expect to receive by retiring early.

When using the SSA calculator, use the year prior to your birth year if you were born on January 1. For example, if your date of birth is January 10, 1959, type that year into the age calculator. However, if your birthday is January 1, 1959, use 1958 as the year to calculate your full retirement age.

Retirement benefits through Social Security are calculated by using your earnings record over the course of your life. The way it works is that the more money that you earn through jobs and self-employment, the greater the monthly benefit that you will receive either at retirement or through SSDI benefits should you become disabled before reaching full retirement age. Benefits that you receive through the Supplemental Security Income are not affected by your work history because SSI benefits are not funded by payroll taxes as are SSDI benefits. Speak with an SSI lawyer at the Clauson Law Firm about questions or concerns you have about the SSI program.

There is a limit on the monthly retirement and SSD benefits that you may receive through Social Security regardless of how much you accrue in lifetime earnings. The maximum monthly benefit for a worker who elects to draw Social Security retirement benefits at full retirement age in 2022 is $3,345. This is also the maximum SSDI benefit.

If you had maximum lifetime earnings and would receive a full retirement benefit of $3,345, it will be reduced by taking early retirement. The reduction ranges between 25% and 30% depending on the number of months from when you take early retirement until your full retirement age.

A better way to understand how early retirement affects what you receive each month, a person born in 1959 would be eligible for full retirement benefits at age 66 years and 10 months. If you had maximum Social Security earnings, you would be eligible to receive $3,345 at full retirement. However, taking early retirement at age 63 subjects you to the early retirement reduction in monthly benefits.

At age 63, you qualify for 75.8% of the maximum benefit you would have received had you waited until you were age 66 years and 10 months. That means you would receive about $2,535 a month. Had you elected to retire at age 62 rather than waiting until age 63, the reduction would have been even greater, and you left you with only 70.8% of the full retirement benefit each month.

The reduction in your monthly benefits is permanent. It continues beyond when you reach full retirement age.

Availability Of Medicare Coverage At 63

Even though you apply for early retirement benefits, it does not affect your eligibility for Medicare. Medicare eligibility generally begins at 65 years of age unless you are disabled and receive SSDI benefits.

If you qualify for Social Security disability, there is a 24-month waiting period before you become eligible for Medicare coverage. However, if your full retirement age is 66 years and 10 months, your eligibility for Medicare starts at age 65 even though you are receiving Social Security disability. Learn more by speaking to a disability benefits lawyer at the Clauson Law Firm.

How Much Can You Get From Social Security Disability At Age 63?

The amount that you receive each month from Social Security disability depends on the earnings record you have from working at jobs or through self-employment. Only earnings on which you paid into the Social Security retirement system through the payment of taxes count.

The maximum monthly SSDI benefit that you can receive in 2022 is $3,345. What you receive may be less based on your earnings record.

If you are age 63 and have a medically determinable physical or mental impairment, expected to last for at least 12 months or result in death, you may qualify for SSDI if the impairment or impairments prevents you from engaging in substantial gainful activity. In other words, it prevents you from doing the activities associated with work, including:

- Standing

- Sitting

- Walking

- Climbing stairs

- Lifting heavy objects

Also included are mental activities, such as the ability to understand and follow instructions.

Applying for SSDI at 63 may be a better option, assuming that you meet the medical criteria, than taking early retirement benefits. If you qualify for social security disability benefits at 63, the amount that you receive each month is equal to what you would get in retirement benefits at age 66 yeas and 10 months or full retirement age. You avoid the reduction in benefits associated with early retirement and you retain full benefits when the SSDI automatically converts to a monthly retirement benefit at full retirement age.

Early Retirement And SSDI Benefits

It takes a quite a while for your application for SSDI benefits to be processed and approved by the Social Security Administration. It can take even longer if your application for benefits is among the two-thirds of claims that are denied at the initial application stage and must go through the appeal process.

While waiting for a decision on your Social Security disability claim, you may be considering filing for early retirement benefits in order to get monthly payments to help meet financial obligations. Although early retirement benefits may look to be an attractive source of income while awaiting approval of your claim for SSDI, there is a risk.

If the SSA approves your application for SSDI and determines that your disability predates the application for early retirement, you will not be subject to a reduction in retirement benefits when the SSDI payments automatically convert to Social Security retirement. However, if the determination by Social Security is that the onset date of your disability came after you began receiving early retirement benefits, your benefits will be permanently reduced because you did not wait until reaching age 66 years and 10 months before applying for retirement benefits.

Getting Assistance From A Social Security Disability Lawyer

Social Security disability and retirement benefits are governed by complicated regulations and procedures that could end up costing you money unless you understand them and how they affect your benefits. Early retirement may offer advantages provided you understand how it works given your particular situation.

A consultation with an experienced SSD lawyer at the Clauson Law Firm gives you access to a wealth of knowledge and information about Social Security benefits and options to meet your specific needs. Contact the Clauson Law Firm today to speak with someone.

How is your eligibility for Medicare affected if you apply for early retirement benefits?

Even if you apply for early retirement benefits, your eligibility for Medicare is not affected. You generally become eligible for Medicare coverage at age 65 unless you start receiving Social Security Disability Insurance (SSDI) benefits before turning 65.

What is the full retirement age for Social Security?

Age 65 remained the full retirement age for those born before the year 1938, but it is gradually increased based on the year of birth from 1938 until it reached age 67 for those born after 1959.

5 Comments

Social security disability check did not come….on the third as usual.It is only 424 dollars.Now my account is overdrawn.I got no notice.Why?

I’m looking for a lawyer to help me I am on SSI and have gotten a letter from the disability office saying I have to take an early retirement at 63 I’m very I’ll can’t loss my health benefits are my retirement check please call me at 903 421 8727 before the 22 of this month

I am 63 year old and i need to know if i can retire at 63 I’m having trouble with my back my hand and I’m in a lot of pain doing my job i can’t afford to quit my job because that the only income i got to live on

Having back problems. Moya moya disease. Dizzy spells. Sleep apnea. Have trouble standing.

I defraud government because I rather be on dope than work have a case open now for deaf hard hearing