How Much Does Long-Term Disability Pay?

Social Security Disability Insurance (SSD or SSDI) and Supplemental Security Income (SSI) are two programs that provide financial support payments to people suffering from physical or mental impairments that are long-term disabilities.

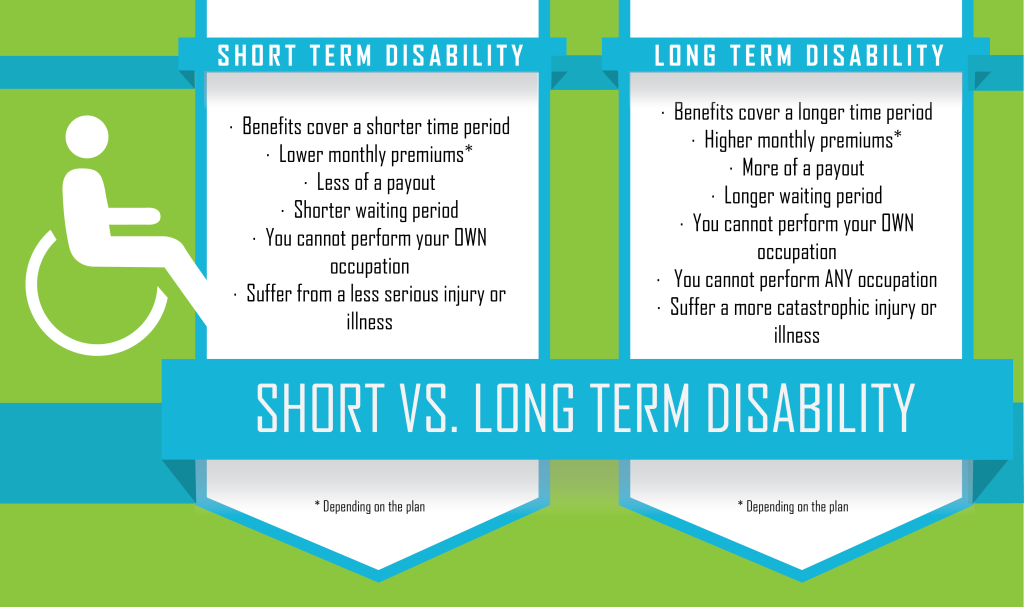

Long-Term Disability v. Short Term Disability

The Social Security Administration has volumes of rules and regulations defining all the terminology and applying all the criteria for most serious impairments. The only disability that the federal government recognizes for purposes of disability payments is long term, which it defines as “lasting or expected to last at least 12 months, or to result in death.”

On the state level, you may live in a jurisdiction that offers generous coverage for the short term, like temporary disability benefits. All states in the U.S. have enacted worker’s compensation systems to provide wage and salary replacement for employees injured or made ill during the course of their jobs.

Otherwise, the only short-term disability that may be available is a private disability policy or one that is provided by your employer. These usually have limited coverage or require that you apply for whatever public payments you qualify for as a condition for them to pay the balance of the assigned benefit.

Social Security Disability vs. Supplemental Security Income

Both Social Security Disability (SSD) and Supplemental Security Income (SSI) use the same definition and criteria to determine if someone is disabled:

A qualifying disability is “any medically determinable physical or mental impairment that lasts or is expected to last up to 12 months, or to result in death, that prevents the person from performing substantial gainful activities.”

But the definition of a disability is about the only thing the two programs share. Here are some of the main differences between SSD and SSI:

Social Security Disability | Supplemental Security Income |

|

|

How Much Does Soc. Sec. Disability (SSD) and Supplement Security Income (SSI) Pay?

Social Security Disability (SSD) and Supplemental Security Income (SSI) use two entirely different processes to determine how much your benefit payment will be. The reason is that each program was created for and serves different groups of people.

SSI is a needs-based program to help disabled people with low income and very few financial resources meet their daily living costs. SSD, on the other hand, is exclusively operated to help disabled workers and former workers who paid into the Social Security Trust Fund throughout their working years. It is essentially an insurance policy for which workers paid premiums every week in the form of payroll withholdings or self-employment taxes.

How Much Does Social Security Disability (SSD) Pay?

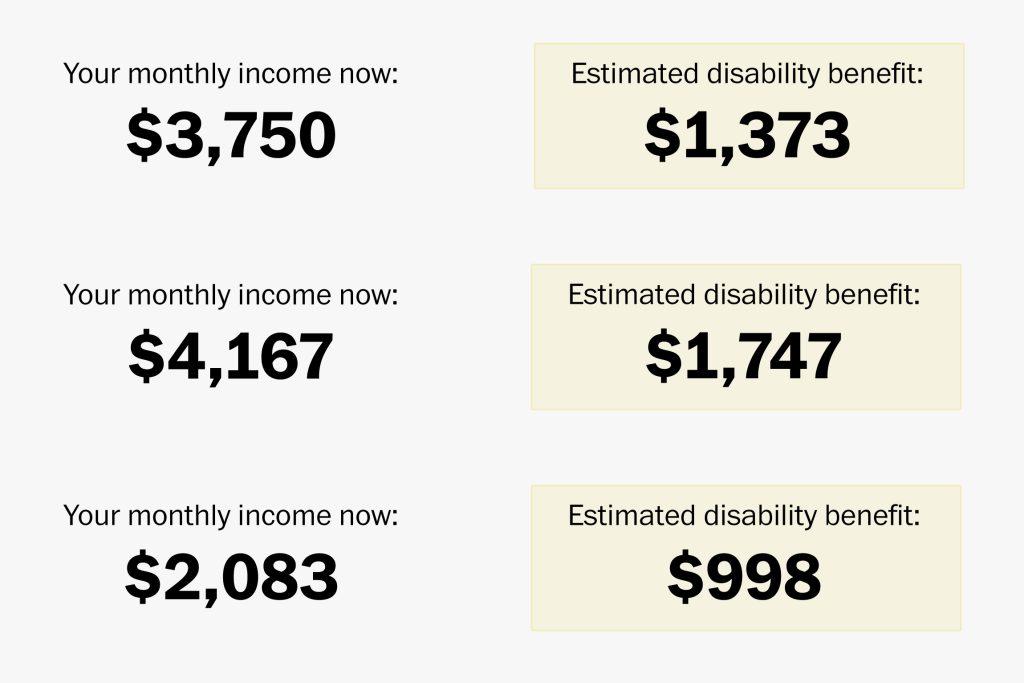

The amount of your benefit payment from Social Security Disability Insurance (SSD or SSDI) is determined by how much income you earned over your 35 highest-earning years. Since that amount is different for everyone, everyone’s SSD benefit is different.

The Social Security Administration keeps a record of all the income you paid taxes on over the course of your entire working career. It takes the highest 35 years’ annual incomes and then “indexes” the income figures by comparing your annual income to the national average income for that year. This allows your income to be adjusted to account for changes in economic conditions over the decades, like inflation.

The resulting figure after your 35 high annual incomes are indexed is called your Average Indexed Monthly Earnings, or AIME. Then the government uses your AIME figure and runs it through the formula we explain below to find out what will be your monthly SSD benefit amount, called your Primary Insurance Amount (PIA).

Here’s how it works with a hypothetical disabled worker we’ll call Mr. Wells:

Mr. Wells worked for 38 years, working his way up to an executive position at his company before becoming very ill with a qualifying disability. He applied for SSDI benefits.

Example:

Mr. Wells’ Average Indexed Monthly Earnings (AIME) over 35 highest earning years is $5,200. Social Security Disability starts with the AIME of $5,200.

- 90 % of the first $1,024 = $921.60, plus

- 35 % of any earnings over $1024 up to $6,172 = $1,336.32, plus

- 15 % of any earnings over $6,172 = $2,297.92

- round down to next lowest $0.10 if not already a multiple of $0.10 = $2,297.90

Mr. Wells’ monthly SSD benefit payment will be $2,297.90.

How Much Does Supplemental Security Income (SSI) Pay?

Supplemental Security Income (SSI) uses an entirely different formula to determine an SSI recipient’s monthly benefit amount. Because SSI is a needs-based program supporting low-income disabled people with living expenses, eligibility for benefits is much more limited than the SSD program.

Instead of looking at someone’s past earnings over a lifetime, SSI looks at only what income they are receiving at the time they apply for benefits.

SSI separates income into two categories, a) unearned income, and b) earned income. Unearned income is anything of value you receive for which you did not exchange any labor, services, or goods. Earned income is what you received in exchange for working, providing some service, or selling something.

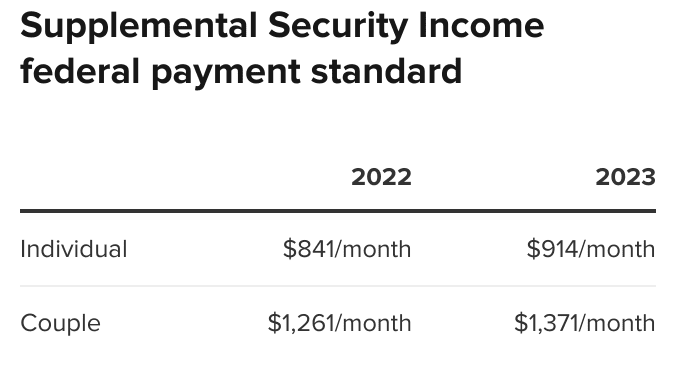

Every SSI benefit recipient begins with the full, maximum benefit amount of $841 (2022).

Then SSI takes the income you report (both unearned and earned) and applies a formula to your “countable income”. SSI considers only countable income that the government defines as anything you can use or benefits your food or shelter needs.

Non-Countable Unearned Income includes a long list of possible public benefits and other income received from not-for-profits: HUD rent subsidies, medical care, state or municipal funded needs-based assistance, heating assistance, transportation subsidies, grants or scholarships or gifts for tuition or other educational expenses, the first $20 of unearned income each month, the first $60 of irregular unearned income in a quarter, and many other income sources.

Countable Unearned Income refers to things that benefit your needs for food or shelter: gratuitous rent reductions by a landlord, contributions toward rent from specific ineligible roommates, interest, and dividends from investments or bank accounts, prizes, winnings, inheritances, etc.

Countable Earned Income and Countable Unearned Income are added together, and any available exemptions and deductions are applied under SSI rules. One example of a deduction is uninsured, disability-related work expenses. Then only a percentage of actual earned income is counted.

Monthly Maximum Benefit Amount Reduced by Nonexempt Income Received Each Month

The SSI benefit calculation process essentially deducts any nonexempt countable income a person receives in a month from the universal maximum benefit amount used as a starting point, $841 in 2022.

An example of the SSI formula applied to a sample case would look like this:

- Your Total Income – Your income that we do not count = Your countable income

- SSI Federal benefit rate – Your countable income = Your SSI Federal benefit

Using sample figures to show you how it works, let’s say a person’s total income $623 and their noncountable income is $285:

- total income $623 minus noncountable income $285 = $338

- Maximum Federal SSI Benefit Amount = $841 minus $338 = $503.

- SSI Benefit Amount = $503.

Experienced Disability Lawyers Maximize Your SSD and SSI Benefit Amounts

Figuring out all the SSD and SSI formulas, equations, exemptions, and deductions is challenging for someone with little experience. The Clauson Law Firm has been helping disabled people win the highest possible disability benefits from both SSDI and SSI for decades. Our entire staff at Clauson Law manages these complex issues on a daily basis. With our years of experience, we know exactly what is exempt, what equations apply to your figures, and how to give you the benefit of every legal opportunity in the regulations to maximize your benefit amount.

Every mistake or oversight an inexperienced advocate or amateur makes in preparing your disability claim will cost you valuable money you and your family need and are entitled to. Don’t take the risk of working with anyone but the experts. Clauson Law firm can handle your disability claim no matter where you are in the country, whether your close by in North Carolina or on the west coast. The Clauson Law Firm handles SSD and SSI claims throughout the United States.

1 Comment

Hello there! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Nonetheless, I’m definitely glad I found it and I’ll be bookmarking and checking back frequently!